Blog

Why is Workers Compensation Important? Workers’ compensation insurance is of paramount importance for businesses, regardless of their size. This type of insurance provides coverage for employees’ lost wages, medical bills, and other expenses in the event of work-related injuries or illnesses. It also serves as a crucial buffer between businesses and potential legal, financial, and…

Read MoreIn the dynamic world of business management, entrepreneurs and business owners face an array of complex tasks and responsibilities daily. Among these, payroll management stands as a critical yet time-consuming aspect that demands meticulous attention. It’s a facet of running a business that requires precision, compliance, and constant adaptation to changing regulations. However, it’s also…

Read MoreIn the ever-evolving landscape of small businesses, entrepreneurs are constantly seeking ways to optimize their operations, reduce administrative burdens, and propel growth. Professional Employer Organizations (PEOs) have emerged as a game-changing solution, offering a comprehensive suite of services that empower small businesses to thrive. From managing HR tasks to navigating complex compliance issues, PEOs provide…

Read MorePay transparency has emerged as a significant topic in today’s workforce, reflecting a broader societal push for equity, fairness, and accountability in the workplace. Employees are seeking greater clarity about their compensation, and employers are being prompted to foster a culture of openness. While federal laws provide some guidelines on pay transparency, each state has…

Read MoreOn July 27, 2023 the IRS issued additional guidance on the Employee Retention Credit (ERC) including additional guidance on Eligibility Rules, Qualifying Orders, Claiming the Credit, ERC Scams, and Recordkeeping. The following is information taken from https://www.irs.gov/coronavirus/frequently-asked-questions-about-the-employee-retention-credit#decline. Please follow the link for additional guidance. Eligibility Rules While the eligibility rules have not changed, the IRS…

Read MoreAs a business owner, navigating the complexities of hiring and maintaining a workforce can be challenging. One of the crucial tasks you must undertake is verifying the eligibility of your employees to work in the United States. To fulfill this obligation, the I-9 Form comes into play. In this blog, we will delve into what…

Read MoreHealthcare costs can be a significant burden for individuals and families, especially with rising medical expenses. Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) are two popular options that offer tax advantages and help individuals save money for medical expenses. In this blog, we will explore the key differences between FSAs and HSAs, their…

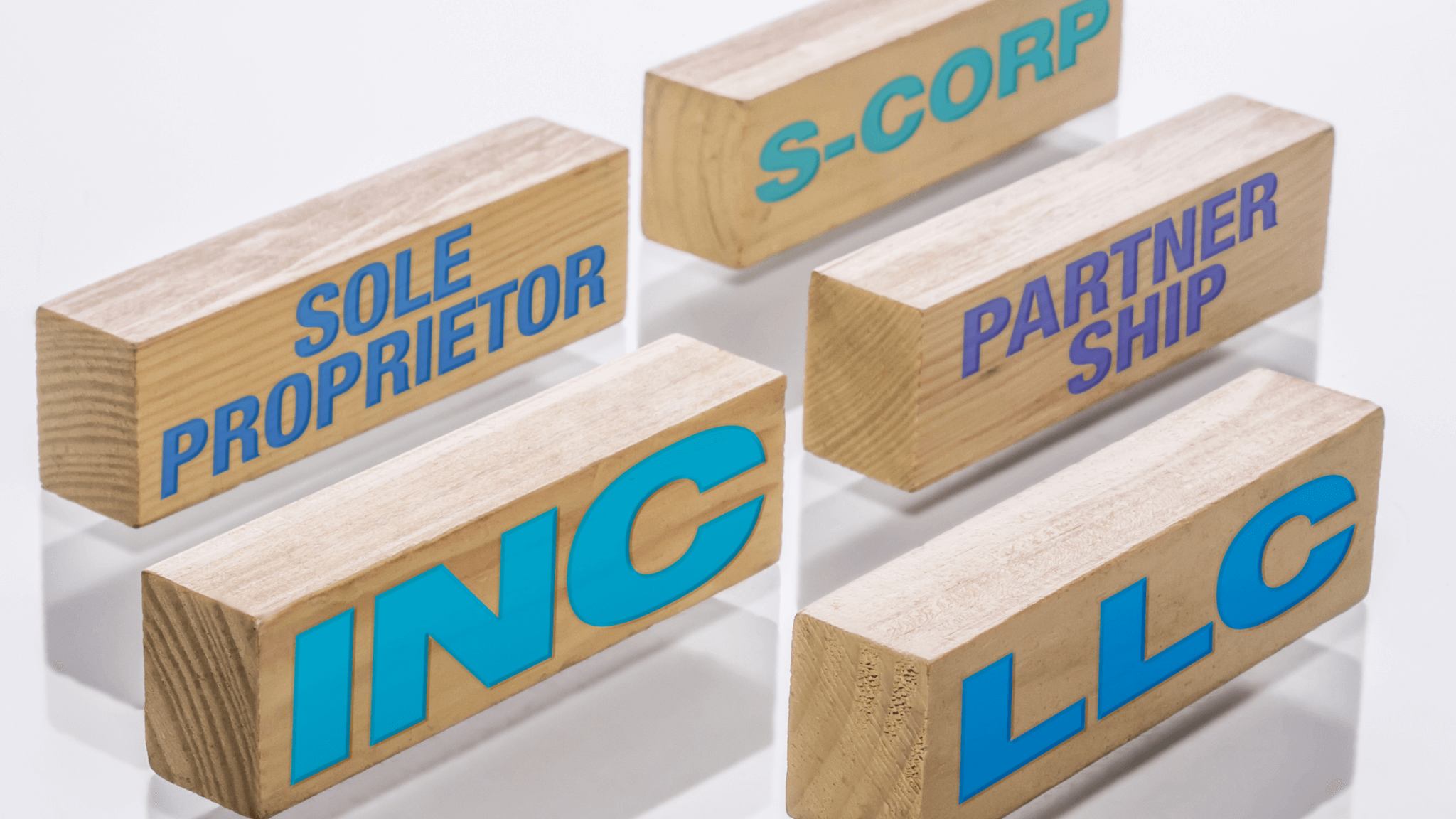

Read MoreIntroduction Starting a business is an exciting venture, but before you dive in, one critical decision you must make is selecting the right business structure. The business structure you choose will not only impact how your company operates but also influence your personal liability, taxes, and overall success. In this blog, we will explore the…

Read MoreStarting a business in the United States requires compliance with various legal requirements at the federal, state, and local levels. These regulations are designed to ensure fair competition, protect consumers, and maintain a stable business environment. While specific requirements may vary depending on the nature and location of the business, there are several key legal…

Read MoreThe United States department of Labor created the Fair Labor Standards Act (FSLA) which establishes minimum wage, overtime pay, recordkeeping, and youth employment standards affecting employees at the state and federal level. When in a work setting, companies have a few different types of employees. You have employees that are exempt and employees that are…

Read More